After completing the Income Tax training course, participants receive a certification that validates their practical knowledge of individual and business taxation. This certification highlights skills in income tax slab rates, deductions, exemptions, tax planning, advance tax, self-assessment tax, challan payments, and ITR filing procedures. It enhances the credibility of accountants, tax practitioners, and finance professionals by proving their ability to handle real-time income tax compliance. Learners gain hands-on experience with income tax portal filing, documentation, and preparation of return forms. The certification boosts career opportunities and equips participants to confidently manage taxation responsibilities for individuals, businesses, and consultancy services.

INCOME TAX

COURSE FEATURES

- Individual Focus on each student

- 100% Placement Assurance

- 100% Practical Approach

- Affordable Fee's Structure

- Trained and Experienced Faculty

- Learn by Doing

- Mock Exams

- Comprehensive Study Material

- Assignments , Notes and Mock tests

- Training Mode: Live online

YES, I AM INTERESTED

COURSE CONTENT

Tax Deducted at Source (TDS) is a system introduced by the Income Tax Department where tax is deducted at the point of income generation. It applies to various payments such as salaries, interest, rent, and professional fees. The deducted amount is then deposited with the government

TDS Calculation involves deducting tax at source on specified payments such as salaries, interest, rent, and professional fees. The applicable TDS rates vary based on the type of payment and the recipient's status. For instance, salaries follow income tax slab rates, while other payments have fixed rates under the Income Tax Act. To calculate TDS, identify the payment type, apply the correct rate, and ensure deductions exceed the threshold limit specified by law. ..

TDS rates vary based on the type of payment and recipient status. For salaries, the tax is deducted as per individual income tax slabs. Interest income from fixed deposits is typically deducted at 10% (or 20% if PAN is not provided). Professional fees, commission, and contract payments often attract rates between 1% and 10%. Additionally, TDS on rent, dividends, and other incomes is prescribed at specific rates under the Income Tax Act, with non-resident payments generally incurring higher rates..

Different types of TDS entries in accounting help track tax deductions and payments accurately. They typically include: TDS Deduction Entry: When tax is deducted at source, record it by debiting the related expense (e.g., salary expense) and crediting the TDS Payable account. TDS Deposit Entry: Once the deducted tax is deposited with the government, debit the TDS Payable account and credit the Bank account. TDS Reversal/Adjustment Entry: For correcting errors or adjustments, reverse or modify the original entry. TDS Interest/Penalty Entry: If interest or penalties are incurred on late deposits, record these by debiting the appropriate expense account and crediting a liability account. .

Tax Deducted at Source (TDS) Payment is the process by which a payer withholds a portion of the payment due to the recipient and remits it directly to the government as tax prepayment. This mechanism covers diverse transactions, including salaries, interest, rent, and professional fees, ensuring tax compliance and aiding in the systematic collection of revenue. Timely TDS payment and proper documentation are essential to avoid penalties and facilitate smooth tax reconciliation for both parties

A TDS Certificate is a crucial document issued by a deductor to the deductee as proof of tax deducted at source. It includes details such as the deductor’s and deductee’s information, amount paid, TDS deducted, and the challan details. Common TDS certificates include Form 16, Form 16A, and Form 27D. Preparation involves gathering accurate data, ensuring proper deductions as per applicable rates, and timely generation through TRACES (TDS Reconciliation Analysis and Correction Enabling System)

TDS returns filing is a mandatory process for deductors to report details of tax deducted at source for various payments such as salaries, interest, rent, and contract fees. Filing involves submitting quarterly returns using prescribed forms like Form 24Q, 26Q, and 27Q, which capture deductions, challan details, and beneficiary information. Timely and accurate filing ensures compliance, helps reconcile tax credits, and avoids penalties or interest for errors or late submissions. Regular review of filed returns is essential.

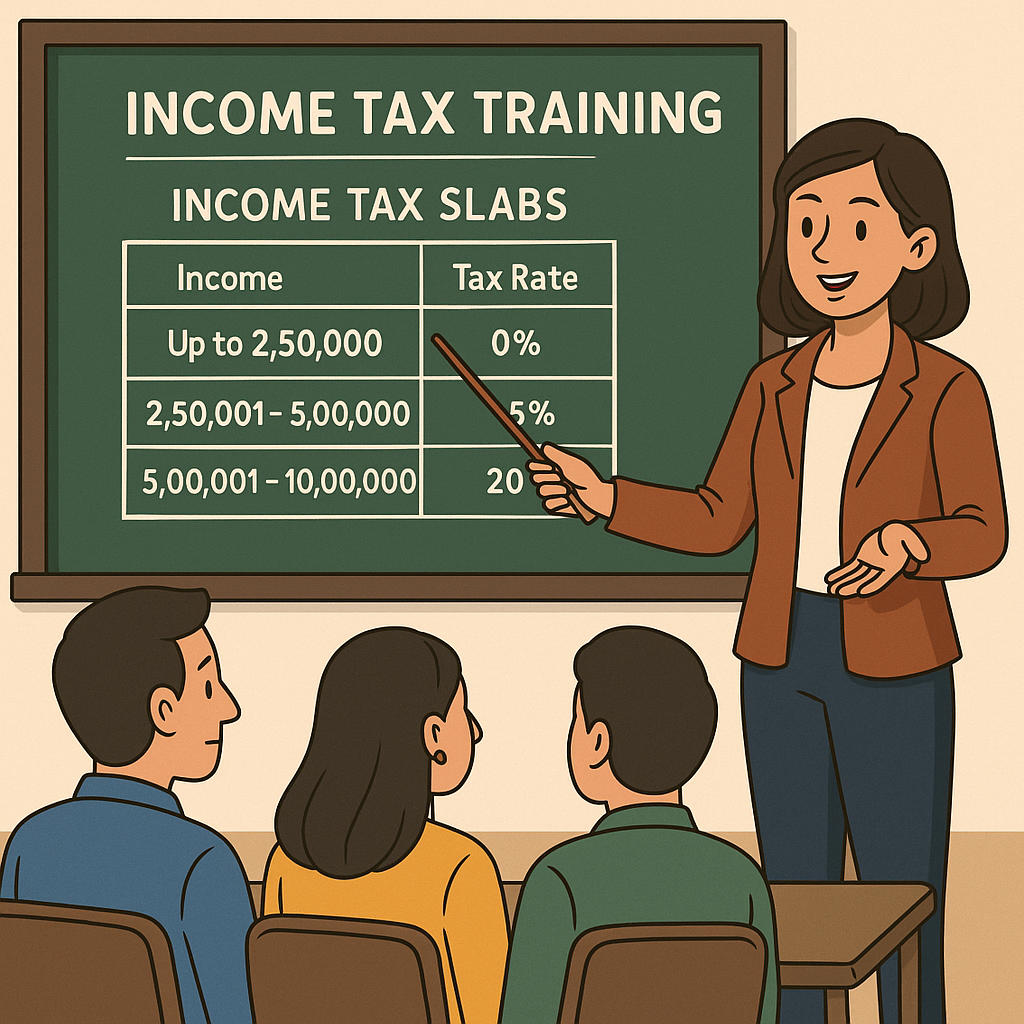

Income Tax is a direct tax levied by the government on the income earned by individuals, businesses, and other entities. It is one of the major sources of revenue for the government, which is used to fund public services such as infrastructure, education, healthcare, defense, and welfare programs. The concept of income tax is based on the principle of "ability to pay," meaning that people who earn more should contribute more to the development of the country. The tax is charged annually, and the rates and rules are generally specified in the respective country’s income tax law.

Income tax for employees refers to the tax imposed by the government on the earnings or salary received by individuals in exchange for employment. It is a direct tax, meaning it is paid directly by the employee to the government and cannot be transferred to another party. In India, income tax on salary is governed by the Income Tax Act, 1961, and it is calculated based on annual earnings, allowable deductions, and the applicable income tax slab rates. .

.

Income tax for businesses is a tax imposed on the net profits earned by a business entity during a financial year. All types of businesses—sole proprietorships, partnerships, LLPs, and companies—are required to calculate their income, deduct allowable expenses, and pay tax as per applicable rates under the Income Tax Act. Businesses must also comply with advance tax and TDS obligations. Corporate entities may be subject to Minimum Alternate Tax (MAT) or presumptive taxation, depending on turnover and structure. Timely filing of income tax returns, maintaining proper books of accounts, and complying with tax audit requirements are essential for legal and financial compliance.

ABOUT FACULTY

The Practical Accounts Faculty specializes in hands-on training for real-world accounting practices. It focuses on essential skills like bookkeeping, financial reporting, tax preparation, and software proficiency (e.g., Tally, QuickBooks). With experienced instructors and industry-aligned curricula, the faculty equips students with the expertise needed for careers in accounting, auditing, and finance. Emphasis is placed on practical application, ensuring students are job-ready and capable of handling complex financial tasks in diverse business environments.

STUDENT TESTIMONIAL

"I am working professional. To upgrade my skills I took training on Taxation. Excellent training."

- Radha Krishna

"I Am Kumar From Visakhapatnam. I Am Taking Practical Accounts Training from Ramesh Sir."

- Krishna Kumar

"One of the best institute in Hyderabad. I am very thankful to Ramesh Sir for inspiring both professionally and personally."

- Prabhakar

"Best way to learn Accounting in this institute. Thank you for guiding me professionally and personally."

- Rajesh Kumar

"Best Institute to get practical knowledge with high care and attention. Concepts are explained multiple times until perfect clarity."

- Madhusudhan

CERTIFICATION

FAQ

What is Income Tax Training?

Income Tax Training provides practical knowledge on income tax laws, return filing, tax planning, TDS, and compliance procedures as per current regulations.

Who should enroll in Income Tax Training?

Students, accountants, tax practitioners, business owners, finance professionals, and anyone interested in taxation careers can enroll.

What topics are covered in Income Tax Training?

The course covers Income Tax Act basics, heads of income, deductions, exemptions, TDS/TCS, ITR filing, and practical case studies.

Is practical ITR filing included in the training?

Yes, training includes hands-on practice in filing ITRs for salaried individuals, professionals, and businesses using real-time examples.

Do I need prior accounting knowledge to join?

Basic accounting knowledge is helpful but not mandatory; the course starts from fundamentals.

What is the duration of Income Tax Training?

The duration typically ranges from 30 to 60 hours, depending on course structure and depth of practical exposure.

Will I receive a certificate after completion?

Yes, a course completion certificate is provided, which adds value to your resume and professional profile.

Does the course cover the latest Income Tax rules?

Yes, the training is updated regularly to include the latest income tax laws, amendments, and compliance procedures.

What career opportunities are available after Income Tax Training?

You can work as an accounts executive, tax consultant, return filing professional, or start independent tax practice.

Is Income Tax Training useful for business owners?

Yes, it helps business owners understand tax planning, compliance, and avoid penalties while optimizing tax liability.